ITR Filing 2025: Here’s What You Need to Know About Form 16 and Return Filing

Form 16 is a crucial document issued by employers to salaried individuals. It provides a detailed summary of their annual earnings and the tax deducted at source (TDS). Many people wonder when Form 16 will be available and whether they can file their Income Tax Return (ITR) without it.

The ITR filing process for the financial year 2024-25 (Assessment Year 2025-26) is now underway. The Central Board of Direct Taxes (CBDT) has released all seven ITR forms required for filing.

The deadline to submit your ITR is 31st July 2025. Filing after this date may attract a penalty, so it’s important to complete the process before the deadline. Several documents are needed for ITR filing, and Form 16 is among the most important for salaried employees. Once Form 16 is issued, individuals can begin filing their returns.

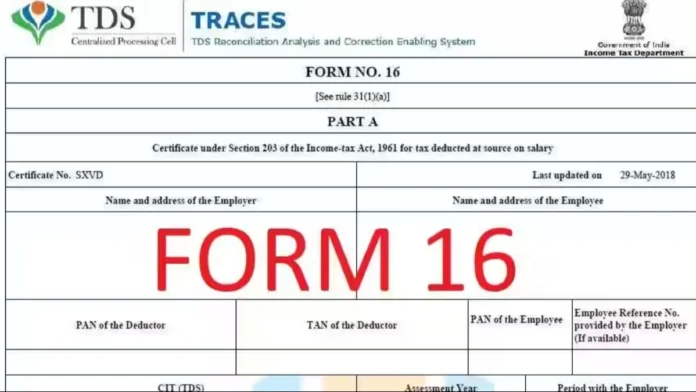

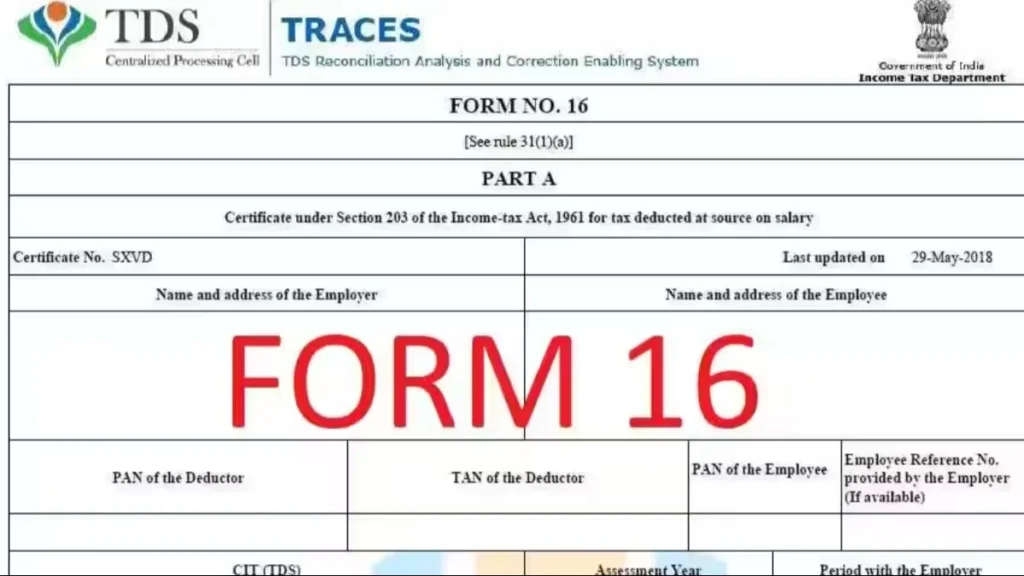

What is Form 16

Companies issue Form 16 to employees. It contains a complete account of the annual income of the salary class i.e. the employed person and the tax deducted on it. Form 16 helps in filing income tax returns easily. Form 16 includes the tax deducted from the salary during a financial year and deposited with the government.

It includes information about the employee’s PAN (Permanent Account Number), employer’s TAN (Tax Deduction and Collection Account Number), income from salary, deductions under various sections of the Income Tax Act and tax deduction at source (TDS). In simple language, Form-16 is a TDS certificate, which lists all your taxable income and various tax deductions at source (TDS).

Form 16 has two parts

Form 16 has two parts. Form 16 Part A and Form 16 Part B. Part A contains the company or institution’s TAN number, employee’s PAN number, name, address, assessment year, period of employment and brief details of TDS deposited to the government.

Part B contains detailed information

Part B contains detailed information. It contains information about the employee’s total salary, house rent allowance, provident fund contribution, TDS, professional tax and deductions made under section 80C, 80D etc. For example, how much you have invested in things like PPF, LIC, health insurance, all these information is there in it. Also, any exemption claimed or tax paid under Chapter VI A of the Income Tax Act, 1961 along with information about the amount of tax fund outstanding and information about tax refund is recorded. This part is most useful while filing income tax return.

Issuing Form 16 is mandatory

Under the Income Tax Act, 1961, it is mandatory for the company to issue Form 16 to those employees whose annual income is more than 2.5 lakhs. If a company does not issue Form 16, it can be fined. Under Section 272 of the Income Tax Act, a penalty of Rs 100 per day can be imposed.

Some changes have been made in Form 16

This year, some changes have been made in Form 16 so that you do not face any problem in filing ITR. Now it will be clearly written in Form 16 that which part of your salary is tax-free, which allowances are not taxed and on which benefits tax will have to be paid. The advantage of this will be that when you sit to file your ITR, you will not have any problem in understanding your salary, tax deduction and taxable income. This will make the process of filing returns easier and faster and the possibility of mistakes will also be reduced.

When will companies issue Form 16

This year companies have not yet issued Form 16 to their employees. Usually companies issue Form 16 for their employees in the month of June. The company or employer makes Form 16 available to its employees by June 15. If you receive Form 16 on June 15, you will get exactly 45 days to file your tax return. If your Form 16 is lost, you can ask for a duplicate from your employer.

You can fill ITR even without Form 16

Now the question arises whether income tax return can be filed even without Form 16, then the answer is yes. If you do not have Form 16, then you can download Form 26AS from the Income Tax website. Form 26AS contains information about TDS, TCS and income received from various income sources.

Apart from this, employed people can also file ITR through bank statement and salary slip because through these also you can know how much your total income has been in a year and how much tax has been deducted. You can also file ITR through Annual Information System (AIS). AIS contains information about all your financial activities like income from salary, income from interest, stock market transactions, TDS and TCS. You can download Annual Information System from the Income Tax Portal.